Guide to Entertainment Payroll

Union Payroll in Entertainment: What It Is and How to Get Started

Union payroll in the entertainment industry involves paying cast and crew in compliance with various union agreements, labor laws, and tax regulations. It’s a critical part of producing films, TV series, commercials, and other projects – especially those using union talent like SAG-AFTRA actors, IATSE crew, or DGA directors. In this comprehensive guide, we’ll explain what entertainment payroll entails, why using a payroll service is essential (and even required for union productions), and how to set up and run union payroll step-by-step. We’ll also show how Topsheet – an entertainment payroll platform – simplifies the process and keeps your production on budget and union-compliant.

TLDR, Straight to the Tools:

- Get Project Setup for Payroll

- Payroll Calculator (Accurately Estimate Payroll Taxes)

Why Topsheet Entertainment Payroll?

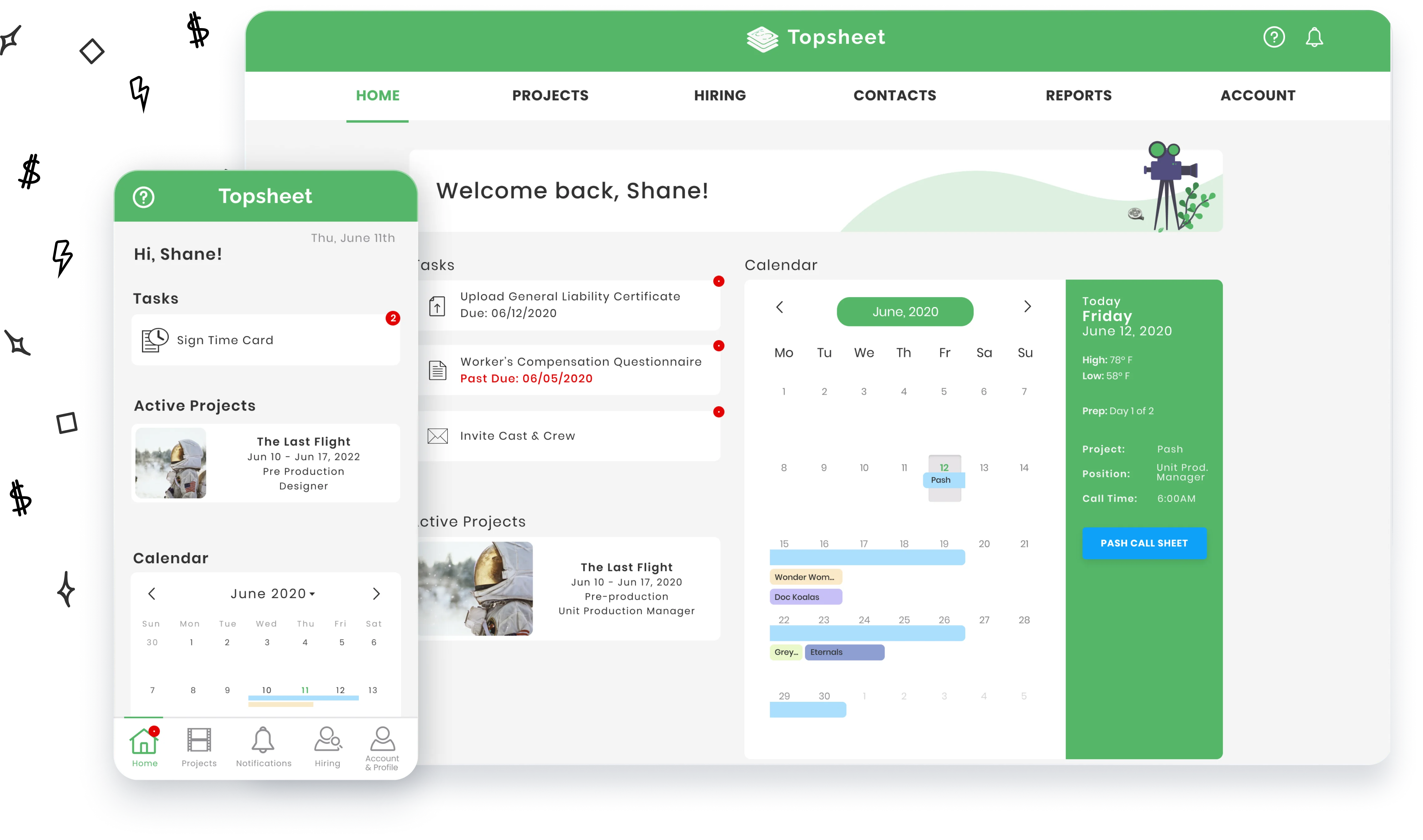

Topsheet is an entertainment payroll solution with call sheets, advanced background handling tools, & automated crew management. Topsheet gives Real Human Support and Communication. Our team is here to help, educate, and assist. An all-in-one software streamlines film productions, saving time and reducing paperwork with an intuitive design.

Have Questions?

If you want to know more about Entertainment Payroll, Union rules, or if you want to get your project set up for payroll, then schedule a meeting with our team, and we will help you get the answers and solutions you need.

Introduction to Entertainment Payroll

Entertainment payroll refers to the specialized process of paying cast & crew on film, TV, and other media productions. Unlike a typical business payroll, entertainment payroll must account for project-based work, varying pay scales for different roles, union rules, and complex overtime and penalty provisions. Productions often hire dozens or even hundreds of short-term employees: actors, directors, camera crew, stunt performers, background extras, etc. Each may belong to a different union or guild (such as SAG-AFTRA for actors, IATSE for many crew positions, DGA for directors and assistant directors, Teamsters for drivers, etc.), and each of these unions has its own contracts dictating minimum wages (“scale” rates), overtime, benefits, and working conditions.

Keeping track of all these requirements is a hefty administrative burden. It’s not just cutting checks – producers or line producers must ensure every worker is paid the correct rate (e.g. SAG-AFTRA scale for actors, union scale for crew), with proper deductions and additional payments like pension and health contributions. They also need to file payroll taxes in multiple jurisdictions and issue the right tax forms. Entertainment payroll companies exist to take this burden off producers. In fact, Topsheet acts as the Employer of Record for your production, handling all payroll taxes and filings and keeping the production compliant in all 50 states. Using a service like this means the payroll company technically employs your crew for tax purposes, ensuring taxes are withheld and remitted properly and all labor laws are followed.

Union payroll specifically refers to processing payroll in accordance with union agreements. If your project hires union members (like SAG-AFTRA actors or IATSE crew), you are obligated to pay at least the union minimum rates and adhere to all union rules – otherwise you could face grievances or work stoppages. Even for non-union projects, you still must obey federal and state labor laws (minimum wage, overtime, etc.), but union rules won’t apply. Many productions today are “mixed-union” – for example, the cast may be union actors while some crew are non-union. In those cases, you have to satisfy union requirements for the union workers and general labor law for everyone else. As we’ll see, a good entertainment payroll service can handle both seamlessly, applying union rules where needed and ensuring legal compliance across the board.

Why a Payroll Service Is Essential – Especially for Union Projects

Running payroll in-house for a film or series is technically possible but fraught with risk. The entertainment industry’s payroll regulations are complex, and mistakes can cost dearly. Here are key reasons a dedicated payroll service is important for any project – and required for union productions:

Union Compliance: Unions like SAG-AFTRA actually require signatory productions to use an approved entertainment payroll company. For example, SAG-AFTRA signatories must process talent payroll through a union-approved payroll service to ensure pension, health, and other contributions are handled correctly. This means if you’re doing a SAG-AFTRA film, you can’t just pay actors directly; you need to go through payroll. The Screen Actors Guild mandates this to protect their members and make sure all payments (wages, residuals, benefits) are properly documented and remitted. Topsheet is a SAG-AFTRA approved payroll company and works with all major unions and guilds, so using Topsheet satisfies this requirement from the start.

Legal Requirements (AB5 and Worker Classification): In California and many states, labor laws have cracked down on classifying film workers as independent contractors. California’s AB5 law (effective 2020) presumes that most workers are employees unless very stringent criteria are met. Essentially, if you’re hiring people to work on making a film (your core business), they must be treated as employees, not 1099 contractors. AB5’s ABC Test says a worker can only be independent if (A) they are free from your control, (B) their work is outside your usual business, and (C) they have an independent business doing that work. On a movie set, criteria B fails for almost every crew member (camera operators, PAs, etc. are integral to filmmaking), so nearly everyone must go on payroll. This means productions have to withhold taxes, pay employer taxes, provide workers’ comp, etc. – tasks that a payroll company handles. Misclassifying crew as contractors can lead to severe penalties. A payroll service helps ensure AB5 compliance, sparing you legal headaches. (One of the few ways around AB5 is hiring people through their loan-out companies, which we’ll cover later, but even then a payroll service is involved in paying that company.)

Taxes and Withholding: On any production, you must calculate and remit payroll taxes for each worker. This includes employee withholdings (income tax, Social Security, Medicare) and employer taxes (the production’s contributions for Social Security, Medicare, federal/state unemployment, etc.). These add roughly 7.65% on the employee side and about 8–10% on the employer side federally, plus additional state taxes. For example, in California an employer pays 0.6% FUTA, 6.2% Social Security, 1.45% Medicare (total ~8.25% federal), and around 6.3% in state payroll taxes, on top of wages. There’s also workers’ comp insurance (~3.5–4% of wages) that employers must carry. When small indie producers first move from paying folks “under the table” or as contractors to doing proper payroll, they’re often shocked that it costs about 15% extra in taxes and insurance. A payroll company like Topsheet handles all these calculations and filings automatically – you just fund the payroll and they take care of sending taxes to the IRS, state agencies, unemployment insurance, etc. Topsheet even provides the required workers’ compensation insurance covering your cast and crew in all states, which is a huge benefit since securing a standalone workers’ comp policy for a short film can be costly and cumbersome.

You can get an accurate estimation of what your production companies payroll taxes will be by using our Payroll Caculator.

Union Pension, Health & Welfare Contributions: If your project is under any union’s jurisdiction, the production must pay into that union’s benefit plans. For instance, SAG-AFTRA requires the producer to contribute an additional percentage of each actor’s gross pay to the SAG Pension & Health plan – currently 21% for principal performers (and ~20.5% for background actors). The DGA (Directors Guild) similarly mandates contributions around 8.75% pension and 11.25% health for directors, assistant directors and unit production managers. IATSE crew locals have their own rates for health & pension (often listed in their agreements or timecards). These payments are on top of wages and are not optional – they must be reported and sent to the union’s trust fund each payroll. A payroll service will calculate these “fringes” and remit them for you. Topsheet automatically handles union pension, health and other dues for union projects. For example, if you’re running SAG-AFTRA payroll through Topsheet, it will add the pension & health fringe to your payroll invoice and make sure those funds go to the SAG-AFTRA plans, keeping you compliant without extra effort.

Overtime, Minimum Wage, and Labor Law Compliance: Entertainment work hours can be long and irregular. Unions and state laws impose strict rules on overtime, breaks, and minimum pay. If you’re not using a specialized payroll system, tracking each person’s overtime (which can kick in daily or weekly), applying the correct overtime rate (time-and-a-half, double time, etc.), and adding penalties for things like missed meal breaks becomes incredibly complex. For example, California law requires overtime after 8 hours in a day and double time after 12 hours, and most union contracts have similar or even stricter provisions. SAG-AFTRA requires that performers receive a meal break by 6 hours into work or the producer must pay a meal penalty ($25 for the first half-hour, $35 for the next, $50 for each subsequent half-hour delay). SAG-AFTRA contracts and DGA contracts also mandate a certain rest period (e.g. 10–12 hours “turnaround” between a performer’s dismissal and next call time); if breached, it’s a forced call violation with hefty penalties (for SAG, one day’s pay or $900, whichever is less, per violation). Working 7 days in a row or on a Sunday/holiday can entitle crew to double-time pay. These are just a few examples – the full list of rules (split days, night premiums, 6th day rates, etc.) is extensive. A payroll service like Topsheet bakes in all these rules. It knows the state and union requirements for each person’s role and will automatically calculate overtime, premiums, and penalties as needed. This not only ensures everyone is paid fairly (and legally), but also saves producers from accidentally violating labor laws. In fact, Topsheet’s platform will verify your team is paid according to state, federal, and union rules based on your project’s details – meaning it will cross-check things like local minimum wage and overtime triggers for the location you’re shooting in, so no one is underpaid.

Streamlined Onboarding and Paperwork: When hiring cast and crew, there’s a flurry of paperwork: start forms like the W-4 (for tax withholding), I-9 (work authorization), any state tax forms, direct deposit info, and for union members, possibly Taft-Hartley reports or union paperwork. Traditional payroll processing often involves collecting physical paperwork from each person, which is time-consuming and error-prone. Topsheet simplifies this by letting you invite crew electronically – each person can create their own account (using their legal name for payroll) and fill out the required forms online. This is especially helpful if you’re onboarding dozens of background actors or day players. Topsheet’s system ensures all necessary data is collected (including work eligibility and tax info) so that everyone can be paid promptly. As the Employer of Record, Topsheet also issues year-end tax documents (W-2s for employees or 1099s for contractors where applicable), so the production doesn’t have to manage that at year’s end.

Saving Time and Avoiding Wasted Time: In the past, productions often hired a production accountant or payroll accountant to manage timecards, calculate overtime, and interface with payroll companies. On smaller projects, producers might try to do it themselves with spreadsheets. Both approaches consume a lot of time. Topsheet was designed to automate payroll and save productions huge amounts of time and money. The Topsheet app can save up to 25x more time on set by automating time cards, calculations, and paperwork – potentially reducing weeks of work to just hours. This means you don’t need to hire an extra person just to handle payroll or spend your own evenings crunching numbers; the software does it in the background. The benefit is not just time saved, but also fewer mistakes and more time for you to focus on creative and logistical tasks. Topsheet’s philosophy is that you should be “telling stories while we take care of all the payroll compliance”.

Given all these factors, it’s clear why a payroll service is indispensable. If you have any union talent, you must run a union-compliant payroll, and even for non-union teams, it’s the safest way to ensure everyone is paid correctly. In many cases, using a professional payroll provider is not just about convenience – it’s about doing things by the book and protecting your production from liability. Next, let’s look at the different types of projects that fall under entertainment payroll and their unique needs.

Types of Projects and Their Payroll Needs

Entertainment payroll covers a wide range of project types, each with its own considerations. Topsheet is built to handle all project types, including films, series, commercials, new media, live events, and more. Here are some common categories and what to keep in mind for each:

Feature Films (and Short Films): Feature film productions, whether big-budget studio movies or independent films, often employ union actors (SAG-AFTRA) and union crew (IATSE, Teamsters, etc.), especially if shooting in Los Angeles, New York, or other union-heavy regions. Film payroll must handle complex union tiers – for example, SAG-AFTRA has different agreements for various budget ranges (Basic Agreement for >$2M, Low Budget, Ultra Low Budget, Short Project Agreement, etc., each with different minimum pay rates). A producer needs to know which agreement their film falls under to budget correctly. For instance, the SAG day rate for a principal actor on a Basic Agreement film (over $2M budget) is $1,246 per day as of 2025, whereas an Ultra Low Budget film (<$300k) has a day rate of $249. There are also limits on how many background actors must be union on certain films (the SAG Basic Agreement requires 57 union background in LA before you can hire non-union extras). Film payroll has to track things like night premiums for night shoots, stunt adjustments, and often advanced features like deferred payments on ultra low projects. Topsheet’s Union Rates includes extensive databases for SAG-AFTRA theatrical rates, DGA rates, etc., so that you can easily find the applicable rates for your film’s budget tier. Films also often have multiple locations (different states or countries), which can affect payroll (for example, different state tax withholding or per diem rules). A system like Topsheet can manage multi-state payroll and ensure state-specific laws (like each state’s overtime rules) are applied correctly.

TV Series (Broadcast, Cable, Streaming): Series production involves episodic television payroll. This can be union-intensive: SAG-AFTRA covers the actors (with separate contracts for TV, like the Television Agreement), DGA covers directors and unit production managers/assistant directors for each episode, and IATSE covers the crew (often different locals for different departments, e.g. camera vs. grip). There might also be a Writers Guild of America (WGA) component for writer-producers on staff (though WGA deals often aren’t processed through production payroll in the same way – they’re more contract payments). TV series have unique pay considerations: actors on one-hour dramas often work on weekly rates, but with guaranteed episodes; there are schedule F deals (flat fees for series regulars), and more complicated recurring payments. DGA rates for episodic directors vary by episode length and network type (for example, a 1-hour network primetime episode has a set minimum fee and guaranteed prep/shoot days). If you’re a line producer on a series, you’ll need to budget for things like “idle days” (days a series regular is not working but still paid), residuals (though those are usually handled by studios/payroll after initial pay), and possibly SAG background actor quotas per episode. Topsheet’s payroll service handles series production including long schedules and weekly timecards. Whether it’s a traditional TV show or a high-budget streaming series, Topsheet can manage the crew payroll across multiple episodes and make sure each episode’s union requirements are met. They stay updated with the latest union scale increases – for example, new SAG-AFTRA TV rates that might go into effect mid-season (new wage rates often kick in annually on July 1 for many union contracts).

Commercials: Commercial productions (TV commercials, online ads) usually have shorter schedules (often 1-3 day shoots) but involve their own union agreements. SAG-AFTRA has a separate Commercials Contract governing performers in ads, with different pay structures (session fees, usage fees, etc.). Additionally, the DGA has commercial director agreements, and IATSE crew might be working under either IATSE or sometimes non-union conditions depending on the region and budget. Commercial actors often have agents that negotiate their fees, and agent commissions (typically 10%) are standard. In fact, agents for actors in commercials or films aren’t allowed to take their 10% fee out of the actor’s union scale pay; instead, the production pays that 10% “above scale” to cover the agent commission. (For example, if an actor’s SAG scale is $500, the agent’s 10% means the production actually pays $550 – $500 to the actor, $50 to the agent.) Commercial payroll needs to accommodate those extra payments to talent agencies, usage payments if the commercial airs, and possibly rapid turnaround (actors are often paid quickly upon session completion). Topsheet makes it easy to pay agents and managers by allowing you to enter an agency’s details and commission percentage when you invite the actor to payroll – the system will automatically send the agent’s portion directly, so you don’t have to cut separate checks or worry about it later. This ensures that both the performer and their representative are paid correctly through the payroll batch.

Animation & Voice-Over Projects: Animated films, TV cartoons, or video games typically employ voice actors who are often members of SAG-AFTRA (under the Animation or Interactive Media agreements). These agreements have their own rate structures (e.g. payment per session or per hour of voice recording, and sometimes use-based residuals for games). Payroll for voice-over sessions might be more straightforward (often paying session fees plus any applicable bonuses for things like multiple voices, etc.), but still requires union reporting. Topsheet can handle SAG-AFTRA voice rates and the reporting of those sessions. One thing to remember: voice actors also often have agents taking 10%, and the payroll should accommodate that similar to on-camera performers. If doing an animation project, you might not have traditional crew payroll (since animators might be salaried or contracted differently), but any union voice talent would go through entertainment payroll.

Documentaries and Industrial Videos: Documentaries may use union crews (camera operators, sound, etc. could be in IATSE) and occasionally SAG-AFTRA if you have union narrators or reenactment actors. However, many documentaries are non-union. Still, payroll is important because even non-union crews must get at least minimum wage and overtime per law. Some documentaries run lean crews with day rates – you must ensure those day rates meet the minimum wage for the hours worked and pay overtime if someone works over 40 hours in a week (or over 8 in a day in certain states). Industrial films or corporate videos might involve union or non-union actors (SAG-AFTRA has an Corporate/Educational contract) and typically are short projects as well. In these cases, a service like Topsheet helps you by automatically applying the correct wage laws and union minima where relevant. For instance, if you’re shooting a corporate video in Los Angeles with non-union crew, Topsheet will still enforce California’s $16.50/hour minimum wage and OT after 8 hours, so you can’t accidentally underpay someone.

Live Events and Broadcasts: Live television events (award shows, live sports broadcasts, news, talk shows) involve talent and crew who are usually union members (AFTRA covers live television performers/personalities, DGA covers directors and stage managers for live shows, IATSE covers stagehands and broadcast techs, etc.). These projects often have short prep and then one intense live day. Payroll must handle short-term hires, sometimes paying by the day or even by the hour. Unions like IATSE may have live event rates or broadcast rates that differ from film rates. It’s crucial to get these right – for example, a camera operator on a live sports broadcast might be working under an IATSE Broadcast agreement with specific hourly wages and overtime after 10 hours, etc. With Topsheet, you would set up the project as a live event, and you could either input the rates manually or use Topsheet’s support to ensure the union local’s rates are applied. After the event, Topsheet would process the payroll quickly, so crew get their checks or direct deposits promptly (which is great for one-day hires).

New Media and Online Content (YouTube, Streaming, VR/AR): The lines have blurred with “new media” projects – content made for streaming platforms or internet release can range from fully union high-budget productions to small creator-driven shoots. SAG-AFTRA has New Media Agreements that cover web series and certain online content, typically with flexible terms if budgets are below certain thresholds. For instance, a low-budget web series might be able to use a SAG-AFTRA New Media contract that doesn’t require standard scale rates, but perhaps just defers payment or pays a lower negotiated rate, as long as certain conditions are met. However, once a new media project’s budget or size is high enough (e.g. a big streaming series on Netflix), the unions generally treat it like traditional TV or film. When dealing with new media, payroll still needs to track hours and pay at least applicable minimum wage. Virtual Reality/Augmented Reality (VR/AR) projects often involve SAG-AFTRA performers (for voice or motion capture) under the Interactive Media Agreement. Topsheet’s adaptability is useful here – you can run payroll for experimental projects the same as any film. The key is to identify which union contracts (if any) apply. If unsure, Topsheet’s team can assist, or you can refer to SAG-AFTRA’s guidelines for new media. Either way, the payroll mechanics (taxes, withholdings, etc.) remain the same.

Music Videos: Music videos are another common production type. SAG-AFTRA covers dancers and performers in music videos under its Music Video Agreement, and crew might be IATSE. Music videos often have short schedules (1-2 day shoots) but can involve stunts, dancers, and complex overtime if the shoot day runs long. Many music videos are non-union for crew, but if the artist is SAG-AFTRA or if professional dancers are involved, you may end up with SAG-AFTRA payroll. A payroll service ensures things like overtime after 8 hours and meal penalties (dancers need meal breaks too!) are properly paid. Topsheet can also easily process payroll for background dancers/extras on a music video, including handling any required union Exhibit G (production time report) if needed. In fact, Topsheet automatically generates Exhibit G reports for union productions. Exhibit G is the SAG-AFTRA weekly timesheet that productions must submit, detailing each performer’s work times and meal breaks. Topsheet producing that for you is a huge time-saver on union sets.

Game Development (Voice Acting/Motion Capture): While video game development is not a filmed production with on-set crew, it does involve hiring voice actors and performance capture actors, often under SAG-AFTRA’s Interactive Media Agreement. If you’re a game producer hiring union voice talent, you’ll likely use a payroll service to pay those actors through a SAG-AFTRA signatory company. The Interactive agreement has session rates and possibly bonuses for number of sessions. Using Topsheet in this scenario is similar to any voice-over project – you’d input the session details, and Topsheet would pay the actor (and agent, if applicable) and take care of taxes and union contributions. The rest of game development staff (programmers, etc.) wouldn’t go through entertainment payroll unless they are being hired as production crew for things like cinematic shoots (some AAA games shoot cutscenes like films, with full crews, essentially making them film productions too).

As you can see, each type of project has specific payroll needs, but the overarching challenge is the same: ensuring everyone gets paid correctly and on time, with full compliance. Topsheet was designed to be versatile across all these production types. Whether you’re crewing up a commercial in Georgia or prepping a feature in Los Angeles, knowing the labor rules and rates is necessary for your budget – Topsheet provides resources like rate sheets and wage tables to help, and then it automates the heavy lifting of applying those rules during production. Next, we’ll delve into some of those rules (taxes, minimum wages, overtime, etc.) in a bit more detail, and explain the concept of loan-out companies which can sometimes come into play.

Taxes, Union Benefits, and Labor Laws: What a Payroll Service Handles

One of the biggest advantages of using an entertainment payroll company is that it takes care of all the “behind the scenes” payments that come with employing people. As a producer, you budget for the wages you owe your cast and crew – but on top of those wages, you’re responsible for a lot more. Here’s a breakdown of what a payroll service like Topsheet will manage for you:

1. Employer Payroll Taxes: When you hire someone as an employee, the production must pay certain taxes. These typically include: Social Security tax (6.2%) and Medicare tax (1.45%) on wages (the employer match portions), Federal Unemployment Tax (FUTA) which is 0.6% on the first $7,000 of wages, and State Unemployment Tax (SUTA) and other state-specific payroll taxes (rates vary by state; e.g. California SUTA is 6.2% on first $7k, plus a small Employment Training Tax). The total employer tax can be around 8-10% federal and another 2-6% state, depending on state. Topsheet’s platform factors all these in – when you run payroll, it will show the employer taxes being added. (On Topsheet’s pricing page, they even let you estimate payroll costs with taxes; for example, on a $0 payroll the employer taxes were calculated as 0 with a $50 minimum fee, but for actual payroll it would calculate the percentages.) This is all done automatically, so you don’t need to manually file quarterly tax forms – Topsheet does it on your behalf as the Employer of Record. Calculate your employer taxes for payroll using our payroll calculator.

2. Employee Tax Withholding: In addition to employer taxes, the payroll service withholds each worker’s portion of taxes from their paycheck. That includes federal and state income tax (based on their W-4 form and state forms), their 6.2% Social Security and 1.45% Medicare, and any other applicable deductions (like state disability insurance in some states). At year-end, Topsheet will issue W-2 forms to each person, showing what they earned and what was withheld. This is critical for your crew and cast, as they’ll need those for their own taxes. Without a payroll company, a production would have to handle all these withholdings and W-2 filings itself, which is very cumbersome.

3. Union Pension, Health & Welfare Contributions: As discussed earlier, union agreements require the production to pay benefit contributions. Each union’s rates differ. A few examples:

SAG-AFTRA: Typically ~21% of gross pay for Pension & Health (this can vary slightly by contract and year, e.g. background actors slightly lower at 20.5%).

DGA: 8.75% pension and 11.25% health (plus a 0.5% contribution for the DGA’s new parent leave fund).

IATSE (Hollywood Basic Agreement locals): around 6% to the pension & health plans, though this can vary by local and classification.

Teamsters Local 399 (in Hollywood): also have health & pension contributions; these can be a flat amount per day or a percentage.

WGA (Writers Guild) if applicable: There are contributions to the Writers Guild Pension Plan and Health Fund, but usually writers’ payments aren’t processed via production payroll unless the writer is an employee (most writers get paid via contract instead).

Other Guilds: There are also the Producers’ Guild (PGA) and others, but PGA isn’t a union with collective bargaining – however, some PGA members might be treated like loan-outs or have other arrangements. Topsheet explicitly mentions handling guilds and unions such as WGA, DGA, Teamsters, IATSE, SAG-AFTRA, “Basic Crafts” (the below-the-line unions) and PGA – essentially covering all industry labor organizations.

When you run union payroll with Topsheet, the system will calculate these fringes. For example, if you pay a SAG actor $1,000, Topsheet will add $210 (21%) as a pension & health fringe line item on your invoice. They will then send that $210 to the SAG-AFTRA benefit plans on your behalf along with the required reporting (so the union knows which actor the contribution is for, etc.). This reporting is crucial – unions require detailed payroll reports each week. Topsheet automatically produces the required union reports (such as Exhibit G for SAG daily timesheets, pension contribution reports, etc.), saving you the pain of filling out those forms manually.

4. Union Dues and Deductions: Many unions also have provisions for deducting dues or other fees from the employee’s paycheck. For instance, SAG-AFTRA members have “working dues” which are a percentage of their earnings (often around 1.575%). These are typically supposed to be deducted from the actor’s pay and forwarded to SAG-AFTRA. A full-service entertainment payroll will handle that deduction so the actor doesn’t have to pay it later – the payroll stub will show the deduction and the union will receive the dues. Similarly, some unions (like IATSE) have assessments or initiation fees that might be handled via payroll deductions if the local requests. Topsheet, by handling union compliance, would process these as needed so that all parties are squared away.

5. Minimum Wage and Overtime Laws: Every state (and some cities) has a set minimum wage and rules for overtime. Even if you’re paying union rates above minimum wage, you must be aware of these laws because they often dictate when overtime kicks in or other conditions. For non-union workers, the state law is the only rule; for union workers, usually the union contract overtime rules apply (which meet or exceed state law in most cases). Some tricky scenarios include: states like California have daily overtime (more than 8 hours a day is 1.5x pay), and double time after 12 hours; some states like New York use only weekly overtime (over 40 hours in a week). A few states have a daily overtime threshold (e.g. Alaska, Nevada have OT after 8 hours), and some have a higher threshold for weekly OT (like straight 40 vs 44 in a couple of states). Minimum wage varies widely – e.g. it’s $7.25 federally, but states like California are up to $16.50 and cities like San Francisco even $19.18. If you shoot in multiple locations, it’s possible different minimum wages apply to different workers. Topsheet’s system is constantly updated with each state’s (and many cities’) wage laws and will ensure that any applicable minimum wage or overtime rule is observed. They provide a handy state-by-state minimum wage and OT chart for producers, so you can quickly check, say, what the overtime trigger is in Georgia (it’s 40 hours/week, since Georgia follows federal law) or what the minimum wage in Los Angeles is ($17.87/hr in 2025). Moreover, as noted, the software will automatically adjust calculations so that, for example, if you somehow set a day rate that works out to less than minimum wage for the hours worked, it would flag or adjust that. This protects you from labor violations and ensures crew are paid fairly. Keeping “on the right side of wage-and-hour law” is explicitly something Topsheet emphasizes.

6. Meal Breaks, Rest Periods, and Other Penalties: Unions have very specific rules about meals and rest, as we touched on. Even some state laws have meal break requirements (California, for example, has meal break labor laws that align somewhat with union rules – meal after 5 hours or pay a penalty, etc., though film unions often have their own negotiated terms). For union productions, payroll needs to be able to calculate meal penalties automatically. For instance, in SAG-AFTRA’s theatrical contract, if a performer doesn’t get their meal by 6 hours, a penalty accumulates: $25 for the first half-hour over, $35 for the next half-hour, $50 for each half-hour after. These penalties reset after a meal is given. Without an automated system, a production accountant would have to track each person’s meal times on each day and manually add the fee to their pay – very tedious and easy to slip up. Topsheet’s digital timecards can track crew clock-in/out and meal breaks (crew can even check in via a GPS-based app for accuracy on call time). The system will compute if a meal was late and add the appropriate penalty to the payroll. Similarly, rest period violations (forced calls) will be caught. For example, if a SAG actor wrapped at 10pm and was recalled at 6am (only 8 hours rest), that’s a forced call violation and triggers a payment (SAG: one day’s pay or $900) – the payroll system can flag that based on call sheet times or reported times. Other premiums like night work (SAG’s 10% premium for hours worked between 8pm–6am on certain contracts) or the DGA’s 6th & 7th day pay (e.g., 150% for a 6th day, 200% for a 7th day) are also accounted for in union payroll processing. The end result: your crew and cast get every dollar they’re owed per the union rules, and you don’t inadvertently cheat them (avoiding grievances or disputes).

In summary, a payroll service handles all the complex financial compliance so you don’t have to. Topsheet specifically takes pride in automating tax filings and union compliance: “Topsheet processes all of the tax information automatically, and even does it for guilds and unions such as WGA, DGA, Teamsters, IATSE, SAG-AFTRA…”. That means once you input your project and people, the platform will worry about calculating federal/state taxes, union pension & health, overtime, meal penalties, etc., according to the rules that apply for each person’s role and location. This is invaluable to producers and accountants because it dramatically reduces errors and saves time.

One area that confuses many new producers is the concept of loan-out companies and how those fit into union payroll, which we’ll explain next.

What Is a Loan-Out Company (Corp) and How to Handle It

In entertainment, it’s common to encounter individuals (often actors, directors, or other high-earning creatives) who ask to be paid via their “loan-out company.” A loan-out is essentially a personal corporation that a performer or crew member has established, allowing the production to contract with the corporation rather than the individual. The corporation then “loans out” the person’s services to the production.

Why loan-outs exist: There are a few reasons:

Tax Benefits for the Individual: By routing income through a corporation, an individual may gain certain tax advantages (potentially deducting more expenses, controlling the timing of income, etc.). The specifics are beyond our scope, but many performers have accountants who advise using an S-corp or LLC loan-out for these reasons.

Liability and Professionalism: Treating oneself as a business entity can offer liability protection and also signal that the person is a professional contractor who works for many clients.

Union and Industry Practice: Unions allow loan-outs. For example, SAG-AFTRA permits members to operate through loan-out companies, but usually certain paperwork is required (like a statement of loan-out on file). The union still treats the person as a member for purposes of benefits and union dues; the loan-out is just the payee.

Legal requirements for loan-outs: If someone wants to be paid via their corporation, that corporation must be a legitimate, registered business in good standing (with a federal EIN, state registration, etc.). Typically:

The individual’s corporation needs to have active Articles of Incorporation or an LLC registration, and be in good standing (e.g. not dissolved or delinquent on taxes). Productions often request a Certificate of Good Standing from the corporation’s state as proof.

The loan-out company must provide a W-9 form to the production, since the production will pay it as a vendor (like any contractor) and issue a 1099-NEC if over the threshold in a year.

In some cases, particularly in California under AB5, the loan-out arrangement should meet the criteria of the business-to-business exemption of AB5: meaning the loan-out truly operates as an independent business (the person has their corporation that provides services to multiple productions, etc.). Even with a loan-out, California’s law has nuances (the loan-out might still need to pass an older test for independent contractor status). However, using a loan-out is currently one of the primary ways entertainment workers continue to work as contractors without violating AB5.

How payroll handles loan-outs: If a cast or crew member is working through a loan-out, the production is not hiring them as an individual employee but rather engaging their corporation. This means:

That person would not be on a W-2; instead, their company would receive payment and later handle paying them (often they are the sole owner, so they just take the income as distributions or salary from their corp).

The payroll company can still facilitate this by treating the loan-out as a vendor payment. Essentially, Topsheet can pay a loan-out corp via accounts payable (just like paying an invoice), separate from the normal payroll cycle. In practice, on Topsheet you might mark that person as a “1099 contractor”, and input their corporation name and EIN. Topsheet does support payments through a corporate loan-out using a W-9, if legal requirements are met. In their FAQ they note: “Contractors (paid on 1099s) are rare and only permitted if they have proper incorporation and meet state requirements (for example, California’s AB5 law restricts contractor status). You can be paid through a corporate loan-out using a W9 if you meet legal requirements.”. This means Topsheet will accommodate loan-outs but will likely require the necessary documentation (W-9, etc.) to ensure it’s legitimate.

Even when using a loan-out, union rules still apply. For instance, if a SAG-AFTRA actor is working via their loan-out company, you as the producer still owe pension & health contributions to the SAG fund for that person. The union will typically require contributions as if that person was an employee, even though their paycheck goes to their corp. In practice, payroll companies handle this by calculating the union fringes on the payments to the loan-out and remitting them to the union, and sometimes they’ll have the individual sign paperwork acknowledging they’re still covered under the union agreement via their corp. The difference is, no taxes are withheld or employer taxes charged, since a corporation is not an employee – the loan-out itself will handle those when it pays its owner.

It’s worth noting that some states (like New York) have begun to treat single-person loan-out corporations as subject to withholding for unemployment insurance, etc. These regulations evolve, but a payroll company like Topsheet keeps abreast of them. If any withholding or specific handling is required for loan-out payments, they will handle it.

As a producer, if you have a mixture of employees and loan-out contractors on your project, a platform like Topsheet is ideal because it can pay both types in one system. Employees get W-2s, contractors get 1099s, and you don’t need a separate process for each.

The bottom line: Loan-outs are a legal mechanism many producers encounter. Always collect the proper documentation (W-9, proof of incorporation) before agreeing to pay someone’s company. And remember that loan-outs are the exception on most productions, not the norm – the majority of your crew, especially below-the-line, will be regular W-2 employees due to laws like AB5. Use loan-outs where appropriate and when requested by above-the-line talent or certain contractors. Topsheet will facilitate those payments so that you remain compliant (for instance, not 1099’ing someone who doesn’t qualify).

Now that we’ve covered all the background and compliance, let’s get practical: How do you actually set up union payroll and run it using Topsheet? The next section will walk through the process step by step, from signing up to paying your team.

Setting Up Union Payroll Step-by-Step (Using Topsheet)

Setting up payroll for a production involves both preparing your production from a union standpoint and configuring the payroll service with your project and crew details. Here’s a step-by-step walkthrough:

Step 1: Become a Union Signatory (if applicable). If your project will hire union members (e.g. SAG-AFTRA actors, DGA directors, etc.), you need to sign the appropriate union agreements before or during the hiring process. Each union has a process:

For SAG-AFTRA, you apply to become a SAG-AFTRA Signatory for your project. This involves contacting SAG-AFTRA with your project info, signing signatory documents, and agreeing to abide by the contract (Basic Agreement, Television Agreement, etc. depending on project type). They will often require a security deposit or bond (to ensure payroll and residuals can be paid). The SAG-AFTRA website provides a list of contracts and agreements and a signatory application form. If you’re using Topsheet, note that Topsheet is an approved payroll company but you still must be a signatory as the producer – the payroll company doesn’t sign on your behalf. Do this early, because unions won’t allow work to proceed (or actors to report to set) until the project is cleared.

For DGA, typically if you’re producing through an AMPTP company or other studio, you’re signed via those agreements. Independent producers can also sign DGA agreements for certain projects. You’d coordinate with the DGA Contracts department (they have rate cards and agree to uphold working conditions). DGA usually goes hand-in-hand with IATSE if it’s a union shoot.

For IATSE, you usually don’t “become a signatory” the same way as SAG; rather, if you are doing a union crew show (like you have a deal with the crew local), you’ll be signing crew deal memos that reference the IATSE Basic Agreement or applicable local agreement. IATSE and Teamsters will expect you to employ their members via a payroll company as well – often the payroll company will send the crew’s hours reports to the benefit plans.

In short, the producer sets up the union agreements in parallel with setting up payroll. It’s wise to engage payroll early, because they can sometimes help or advise on this process. Topsheet, for example, is very familiar with union onboarding and can ensure you have the right forms and contact info.

Step 2: Create a Topsheet Account. If you haven’t used Topsheet before, you’ll need to sign up as a new user. This is straightforward: go to the Topsheet website or download the app, and create an account with your legal name, email, and phone number. (Use your legal name because for payroll purposes that’s required – you can set a display name if needed, but all tax documents use the legal name.) You’ll create a secure password and verify your phone or email. Once your account is made, you can log into the Topsheet web app (admins must use the web app, not mobile, for full functionality).

Step 3: Set Up Your Project in Topsheet. After logging in, you’ll create a Project within Topsheet. This usually involves entering basic info like the project name, type (feature film, commercial, etc.), primary production state (for tax calculations), and whether it’s union or non-union. Topsheet will likely ask for the production company’s details as well, since that ties to tax filings. When setting up a project, you might also need to “register” the payroll project by providing details of your production company (EIN, address) and possibly linking a funding source. Topsheet serves as Employer of Record, but they still need your company info for record-keeping and any required state registrations. Don’t worry – this is often just a one-time setup per project or company. Topsheet does not charge anything for project setup or union setup, so you can create projects freely. If your project is union, make sure to indicate that so the system knows to apply the union’s rate rules (it might even ask which unions are involved). Topsheet supports union and non-union productions equally – if union, it will automatically handle things like Exhibit G, pension, etc., as we discussed.

Step 4: Fund Your Payroll Account. Before you can pay people, you need to get money into the payroll system. Typically, payroll companies either require a wire/ACH deposit of the estimated payroll amount (plus a cushion) or they may extend credit if you’re a long-standing client. Topsheet’s model is to charge a flat 2% fee (with $50 minimum per batch), and they don’t mark up or add extra union fees. That fee and the employer taxes will be part of your total cost. You will usually transfer funds to Topsheet’s account for each payroll run (or sometimes keep a prefunded account from which each week’s payroll is drawn). This step ensures that when payroll is processed, Topsheet can pay everyone (including taxes) on time. In the Topsheet interface, you’ll see instructions for transferring funds – many productions do an ACH transfer or wire from their bank to Topsheet’s trust account, referencing their project ID. Plan ahead: send the money a couple days before you need payroll processed to avoid any delays.

Step 5: Invite Your Crew & Cast to Join the Project. Once your project is created, you can start adding your team. Topsheet has an “Invite Crew” or “Invite Cast” feature on the project page. You will enter each person’s name, position/role, department, rate of pay, and their contact info (usually phone or email). If a person has an agent or agency commission to pay, you can input the agent’s details and commission percentage at this stage as well. For example, for a SAG actor with a 10% agent, you’d enter the agency name and 10%, and Topsheet will automatically calculate the agent’s fee on top of the actor’s gross. You can also add any additional pay items like allowances or kit rentals in their profile. When you send the invite, the person will receive a link to create their own Topsheet account (if they don’t have one) or to join the project if they do. They’ll be prompted to fill out their start paperwork (W-4, I-9, etc.) online. Topsheet’s FAQ notes that if an employee is on a Topsheet project, they’ll need to input their tax forms and payment info so they can be paid. As the project admin, you can track who has completed their paperwork. This digital onboarding is a huge time-saver – no physical start packets to collect on day one of shooting. Everyone from your lead actors to a day-playing grip can be invited and set up in the system ahead of time.

Step 6: Set Up Timecards and Work Hours. During production, you or your production coordinator will be responsible for inputting each person’s work hours or approving their submitted timecards. Topsheet provides digital time card tools. Crew can use the mobile app to clock in/out or enter their hours, and you just approve them in the web dashboard. Alternatively, you can manually enter each person’s in/out times from the daily call sheet. For weekly-salaried actors or crew, you might just mark them present for the days they worked. The system will automatically calculate any overtime or penalties based on those times. For example, if an actor’s work time exceeds the 6-hour mark without a meal, a meal penalty line will appear. If a crew member worked 14 hours, the 2 hours beyond 12 will be flagged as double-time pay. You also input any additional payments or reimbursements here – e.g. per diem amounts for travel days, mileage reimbursements, or kits (gear rental fees some crew get). Many union agreements have fixed per diem rates (like SAG’s $70/day for meals on location); you can use those guidelines to set the amount, and Topsheet will include it as a non-taxable reimbursement (if within IRS limits). The system will also handle any union-specific categorization, like if someone is on a “travel-only day” or a “idle day,” etc., based on how you input the info.

Step 7: Review Payroll Totals and Approve the Run. Before actually running payroll, you’ll usually get a summary of the payroll preview: how much each person is getting, the taxes, fringes, fees, etc. Carefully review this. Topsheet’s interface will show employer taxes and fees transparently. Make sure everyone’s rate is correct (compare against deals or timecards), and check any large overtime charges or penalties to ensure they’re expected. If something looks off, you can adjust time entries or reach out to Topsheet’s support for clarification. This preview is your chance to catch errors (like a crew member’s time was entered wrong, or someone missing from the list). It’s also when you’ll see the 2% handling fee applied and ensure you have funds to cover everything. Remember, Topsheet doesn’t nickel-and-dime with extra fees for cutting checks or union handling – it’s just the flat percentage, which keeps budgeting simple.

Step 8: Process Payroll – Topsheet Pays Your Team. Once you approve, Topsheet will process the payroll. They will debit the funds you provided (if they haven’t already) and issue payments to each worker. Payments are typically via direct deposit (if the person provided bank info) or via live check if necessary. Topsheet’s system is designed for quick turnaround – after timecards are approved, payroll is often processed within a few business days. Many crew will see the direct deposit in their account shortly after. This is a welcome change if you’re used to older payroll services that might take a week or more. With Topsheet, cast and crew “get paid faster than ever with our direct deposit.”. Meanwhile, Topsheet will also pay out any agent commissions (sending those directly to the agency on file), and handle union benefits and taxes as described. From the production side, your obligations are done – Topsheet as EOR takes care of cutting all those checks (or rather, electronic transfers).

Step 9: Ongoing Reporting and Wrap: Throughout the production, you can run reports in Topsheet to see costs by category, track how much of your budget is used, etc. Because Topsheet is digital, you have a clear audit trail of every hour and penny. If SAG-AFTRA or another union requests time sheets or reports, you have them at your fingertips (Exhibit G forms, pension reports, etc.). At the end of production (and the calendar year), Topsheet will handle all final tax filings, W-2 issuance, and any required reporting to unions (like final cast clearance reports, if applicable). If any issues arise (say an actor disputes a time, or a state agency questions something), Topsheet’s team will work with you to resolve it. They pride themselves on being available to help – you can book meetings for walkthroughs or questions. Essentially, they become your payroll department on call.

By following these steps, even a first- or second-time producer can successfully navigate union payroll. Topsheet was built to guide users through it – for example, their interface might prompt you if you forget to add something (like a SAG actor missing a meal penalty, etc.). And if you need extra help, their support and educational resources (blogs, guides) are there to assist.

Let’s illustrate a mini-scenario: Suppose you’re a line producer on a $1.5 million indie film. You have 3 SAG-AFTRA actors (all at scale), a DGA director, and IATSE crew. You become SAG-AFTRA signatory, deposit a security bond with SAG, and sign with the DGA as well. You sign up on Topsheet, create your project, mark it as a Low Budget SAG film (so SAG Low Budget rates apply). You invite your actors, director, and crew via Topsheet. Your actors fill out their W-4s and I-9s; one actor’s agent gets 10% so you note that. During week 1 of shooting, one day goes long – one actor hits 2 meal penalties and some OT, some crew go into double-time at 14 hours, and there’s a 6th day shoot on Saturday. You enter or approve all this in Topsheet. It automatically adds the correct penalties and 6th day premiums. When you review the payroll, you see each actor’s gross, plus their pension (21%) calculated; the DGA director’s pay with 8.75% pension/11.25% health fringe; each crew’s overtime; all employer taxes listed; and the 10% agent fees for that one actor. Everything looks right, so you approve. Topsheet then does direct deposits to the crew, the actors, sends the agent fee to the agency’s account, and pays the unions and IRS. Your crew get texts that they’ve been paid. The next week, SAG-AFTRA business reps drop by set for a surprise visit (it happens!), and you confidently show that you’re using Topsheet – an approved payroll – and all Exhibit Gs are being auto-generated. The reps have no issues. You’ve just run union payroll smoothly without a hitch, and without having to personally calculate a single tax or overtime rate. That’s the power of a modern payroll service.

Why Topsheet Is the Best Choice for Entertainment Payroll

There are a few established companies in entertainment payroll (Entertainment Partners, Cast & Crew, etc.), but Topsheet has introduced a next-generation approach that offers distinct advantages for producers and production accountants. Here’s why Topsheet stands out as one of the best (if not the best) entertainment payroll services today:

All-In-One Platform: Topsheet isn’t just a payroll processor – it’s a full production management tool. In addition to payroll, it offers features like scheduling, call sheets, time cards, and crew management in one app. This integration means your crew’s work hours flow directly from digital timecards to payroll without double entry. You can create and distribute call sheets through Topsheet and track crew check-ins, which ties into attendance for payroll. Fewer fragmented tools = fewer errors and less work.

Union and Non-Union Expertise: Topsheet is built from the ground up to handle union rules. It works with all unions and guilds – SAG-AFTRA, IATSE, DGA, WGA, Teamsters, and more – as well as non-union projects. Many newer payroll startups only handle simple non-union payrolls or require manual setup for union rules. Topsheet, however, automatically handles things like SAG Exhibit Gs, union pension/health, and compliance reporting. This depth of union compliance automation is a huge competitive edge. Whether you’re doing a small non-union indie or a union signatory production, the system configures to your needs.

Fast and Paperless Onboarding: Topsheet eliminates the dreaded start paperwork packets. It’s all digital – crew and cast sign up online, fill out W-4, I-9, etc., and even sign deal memos or any custom documents electronically. This not only saves trees (no paper) but speeds up onboarding. Background actors can even fill out their info on their phones before a big crowd scene, which is far more efficient than wrangling stacks of paper on set.

Real-Time Access and Transparency: As a producer or accountant, you have real-time access to your payroll data. On Topsheet’s dashboard you can see exactly how much has accrued in payroll at any point, broken down by category, and what taxes or fringes are being added. This is fantastic for budgeting and cost reporting – you can compare your line-by-line budget (e.g. “Actors” or “Grip Department”) to the actual costs coming through in near real-time. The platform essentially gives you up-to-the-minute payroll actuals, so you’re never caught off guard by overages. Traditional payroll services often send reports weeks later or require requesting specific reports.

Cost-Effective Pricing: Topsheet’s pricing model is simple: 2% of payroll with a $50 minimum per batch. They do not charge setup fees, per-item fees, or union handling fees. Many legacy payroll companies charge separate fees for each W-2 generated, each check or deposit, and add surcharges for things like processing union benefits or start paperwork. Those can add up for a large crew. Topsheet’s flat 2% often ends up cheaper, especially for higher-budget projects (since other vendors might charge 2% plus extras, whereas Topsheet caps it at just that). For smaller projects, 2% is very reasonable – e.g. a $100,000 payroll would be $2,000 fee. And remember, that fee covers all the time-saving and compliance features, likely saving you more than its cost in labor hours.

No Upcharges for Union Work: It’s worth emphasizing – some payroll services historically charged extra percentages for handling union fringes or dealing with guilds. Topsheet explicitly does not upcharge for union payroll. You pay the same rate whether your project is non-union, partially union, or fully union. This encourages independent producers not to shy away from union compliance due to cost concerns. Topsheet wants to help productions of all sizes and budgets remain compliant without financial penalty.

Worker’s Comp Coverage Included: Topsheet provides worker’s comp insurance coverage for your production under their policy. This is a big deal – arranging worker’s comp on your own can be a hurdle, especially for short projects. With Topsheet, your crew and cast are covered for workplace injuries under their umbrella (usually the payroll company becomes the employer for worker’s comp purposes). And they cover all states, so if you shoot in multiple locations, you don’t have to get separate policies.

Modern and User-Friendly: Topsheet is a modern web app and mobile app, designed to be intuitive. Many entertainment payroll processes are notoriously old-fashioned (faxes, anyone?). Topsheet instead provides a clean UI, and even features like GPS check-in for background actors (so you know exactly when extras arrive on set). Crew can access their digital paystubs through the app and see their own hours. As an admin, you can generate reports with a click. This user-friendliness reduces friction in the payroll process – fewer phone calls and emails to the payroll company because you have the info readily available.

Speed and Efficiency: Because of automation, Topsheet can process payroll extremely fast. Once you finalize a payroll, you don’t wait long for processing. This means crew get paid faster, which makes for happier crew. Quick pay also helps with things like turnaround – for example, if you have day players who work just one or two days, they’ll get their pay swiftly rather than waiting until end of the week or longer. In an industry where cash flow for workers can be tight, fast payroll is a morale booster.

Production Resources and Support: Topsheet doesn’t just give you software – they provide education and support. Their blog and education center contain up-to-date info on union rates (they had an article with 2025 SAG-AFTRA theatrical rates updated, and a producer’s guide to DGA rates, etc.), as well as guides on laws like AB5. These resources help producers stay informed. And if you need personalized help, you can schedule a meeting or demo with the Topsheet team. They understand that transitioning to a new system can be daunting, so they’ll walk you through it. They even offered in one blog to send crew to set in LA to help productions onboard for free– showing a commitment to customer service that goes beyond the typical.

Scalability: Whether you’re doing a small one-day shoot or a year-long production, Topsheet scales with you. They have designed the system to handle all project sizes – from a tiny indie to a large studio feature with thousands of background extras. The infrastructure and team can manage high volume (like hundreds of timecards a day) just as well as they handle a small team. This means you don’t have to switch payroll services as you grow; Topsheet can be your go-to for every project, big or small.

Future-Proof and Continually Updating: Being a tech-forward company, Topsheet is likely to keep adding features producers need. For example, as new regulations come (paid sick leave laws, new union agreements, etc.), Topsheet can update its software quickly to comply. They already updated their system for things like new SAG-AFTRA agreements effective in 2025. This agility ensures your production won’t accidentally fall out of compliance due to outdated info – Topsheet stays current for you.

In essence, Topsheet offers the professionalism and reliability of a traditional entertainment payroll firm, combined with the speed, cost-efficiency, and ease-of-use of modern fintech software. It’s like having a seasoned payroll accountant and an advanced software assistant in one. Producers who have used older systems will appreciate not dealing with mountains of paper and delayed reports, and newer producers will find Topsheet approachable as a self-service tool. By focusing on being producer-friendly and crew-friendly (a smooth experience for the workers too), Topsheet has positioned itself as a top choice in Hollywood and beyond.

Above all, Topsheet’s all-in-one payroll platform keeps your production on schedule, on budget, and union-compliant In a business where time is money and compliance is key, having that peace of mind is invaluable.

Conclusion

Union payroll may seem intimidating with its myriad rules and requirements, but with the right knowledge and tools, it becomes a manageable (even smooth) part of the production process. In this guide, we covered what entertainment payroll involves – from handling taxes and union benefits to abiding by overtime and minimum wage laws – and why using a specialized service is crucial. For producers and line producers, understanding these details isn’t just about avoiding penalties; it’s about taking care of your team. Paying your cast & crew correctly and promptly is part of running a professional production.

Topsheet enters this picture as not just a payroll service, but a partner in production management. It simplifies and automates the heavy lifting of film & TV payroll, whether you’re dealing with SAG-AFTRA actor salaries, IATSE crew timesheets, DGA director fees, or all of the above. By walking through how to set up and run payroll with Topsheet, we’ve seen that even a producer doing this for the first time can get through it step-by-step. The platform is built by entertainment industry experts with real on-set experience, which is why it addresses common pain points (remember those meal penalties and agent payments).

For producers embarking on projects in the $1M+ budget range (or any size really), using Topsheet can provide the confidence that your payroll will be handled accurately and efficiently. It’s like having a seasoned payroll accountant, compliance officer, and paymaster all in one app – available wherever you are. This means you can devote more energy to creative decisions and logistical planning, rather than chasing timecards and tax tables.

In the end, a well-run payroll is invisible – your crew and actors are happy because their paychecks arrive correctly and on time, the unions are satisfied because all dues and benefits are paid, and you as the producer have no fires to put out in accounting. That’s the outcome Topsheet strives to deliver. It turns payroll from a potential headache into a seamless background process.

We hope this comprehensive overview has demystified union payroll and shown you the ropes of setting it up. With knowledge, preparation, and the help of Topsheet, you’ll be able to navigate entertainment payroll like a pro – keeping your production both compliant and crew-friendly. After all, when payroll goes right, the production can focus on what really matters: creating amazing content on screen, on time, and on budget.

Ready to roll camera on your next project? With Topsheet handling your payroll, you’ll be ready to “call action” knowing the crew is taken care of from budgeting to wrap and beyond

Have Questions?

If you want to know more about Entertainment Payroll, Union rules, or if you want to get your project set up for payroll, then schedule a meeting with our team, and we will help you get the answers and solutions you need.

More Resources

If you want to learn more, Topsheet has an extensive library of free education on the film industry. We are updating our education weekly and staying on top of the latest in the film industry for producers and production teams.

IATSE Theatrical Theatrical Rates 2025–2026

The complete 2025–2026 IATSE theatrical rate sheets — covering Locals 44, 80, 600, 695, 700, 706, 728, 729, 800. Including pension, rest periods, etc.

Background Casting Calls

Background Actor Casting calls across the USA, including LA, NY, and TX, updated weekly to give you the latest jobs in your area.

Background Actors

Looking for background casting calls? Topsheet is free for background actors casting, a casting network available in all 50 states.

Complete Guide Film Tax Incentives

Learn 2025 film tax incentives by state: credits, rebates, requirements, and payouts. Maximize savings with Topsheet’s payroll and audit-ready tools.